[ad_1]

ADP, or Automatic Data Processing Inc., is a leading provider of comprehensive payroll, human capital management, benefits management and business process outsourcing solutions. With a presence in more than 140 countries, ADP is one of the largest HCM and payroll software providers in the world.

For most small and midsize businesses, Gusto is the best overall alternative to ADP, especially ADP RUN. However, there are several alternative solutions available with similar features and capabilities as ADP. In this analysis of ADP competitors, we’ll assess their core services, features and capabilities, customer experience and pricing strategy to identify the leading ADP alternatives in the market and what differentiates them.

Jump to:

Top ADP competitors and alternatives: Comparison table

| Product | Starting price per month | Free trial | International payroll | Time tracking | Tax filing and payment |

|---|---|---|---|---|---|

| ADP | Custom | 3 months | Yes | Yes | Yes |

| Gusto | $40 + $6/payee | 30 days* | Contractors only | Yes | Yes |

| Rippling | $8/payee | None | Yes | Yes | Yes |

| Papaya Global | $12/payee | None | Yes | Yes | Yes |

| QuickBooks Payroll | $45 + $6/payee | 30 days | No | Yes | Yes |

| Paycor | Custom quote | None | No | Yes | Yes |

| OnPay | $40 + $6/payee | 30 days | No | Yes (third party) | Yes |

| Paychex | $39 + $5/payee | None | Yes (third party) | Yes | Yes |

Top ADP competitors

Gusto: Best overall ADP alternative

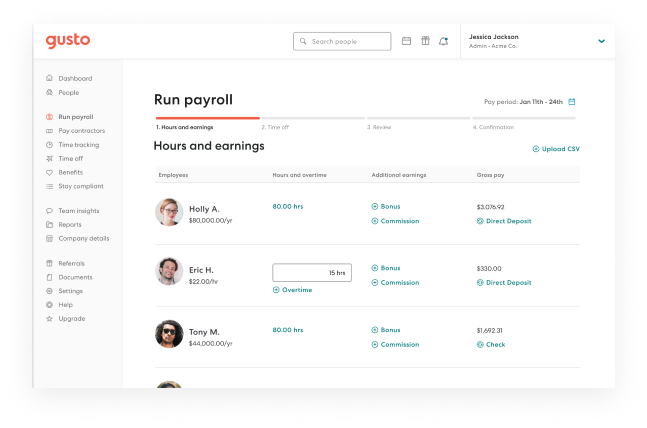

Gusto is an online payroll, benefits and HR platform that automates employee information management, taxes and payroll. Its services are similar to those of ADP RUN, which is ADP’s payroll service for small and midsize businesses. Like ADP RUN, Gusto’s features include automated payroll processing, time tracking and self-guided onboarding.

Gusto is quickly becoming a popular choice for businesses that want an easy-to-use and affordable payroll solution. Unlike ADP, Gusto automatically generates and sends W-2s and 1099s to employees and contractors at no extra cost. Gusto also offers free, self-guided setup and migration for new users, unlike ADP, which charges a setup fee.

To learn more about Gusto’s plans and features, check out our Gusto review.

Gusto’s pricing

Gusto has three scalable plans that target small and midsize businesses. All fees listed below are charged monthly:

- Gusto Simple: $40 + $6 per payee

- Gusto Plus: $80 + $12 per payee

- Gusto Premium: Custom pricing

Gusto’s key features

- Comprehensive full-service payroll.

- Free W-2 and 1099 form filing.

- Add-on benefits through Gusto’s brokerage.

- Free benefits integration and administration.

- Optional contractor-only payroll plan.

- Optional international contractor payroll service.

Gusto pros

- More payroll features than most competitors.

- No additional fee for end-of-year tax-form filing.

- Free time clock integration.

- Optional benefits options with free integration and administration.

- Dozens of built-in integrations with accounting software, time tracking software and more.

Gusto cons

- Limited HR features with two cheapest plans.

- No true 24/7 customer service.

Rippling: Best for growth

Rippling is a uniquely comprehensive payroll, HR, benefits, personnel management, finance and IT management solution for businesses large and small. Instead of offering a one-size-fits-all solution, Rippling lets businesses create their own custom packages with as many (or as few) features as they need.

For instance, small businesses with two or three employees might choose to pay for payroll alone or opt for Rippling’s PEO plan. Meanwhile, multinational entities could choose to create custom packages with ATS, LMS, payroll, benefits, employee expense management, thorough analytics and remote device management. Whatever package you build will be uniquely suited to your business only.

To learn more about Rippling’s plans and features, check out our Rippling review.

Rippling’s pricing

Most of Rippling’s features cost a per-person fee, though some may cost a monthly fee only or some combination of monthly and per-user fee. Payroll pricing starts at $8 per employee paid per month along with a custom base price. To get pricing for all other services — including the monthly base price for Rippling Unity, Rippling’s base operating system — get in touch with a sales representative.

Rippling’s key features

- Automated full-service payroll for employers and employees.

- Built-in time tracking tool.

- Optional employee benefits add-ons and administration.

- Global benefits and payroll plan.

- Remote device management, including device onboarding, app management, password management and secure employee offboarding.

Rippling’s pros

- Extremely comprehensive features.

- Scalable all-in-one HRIS platform.

- Responsive customer service.

- Frequent updates based on customer feedback and requests.

- Excellent customizations and automations.

Rippling’s cons

- Potentially high learning curve for first-time software users.

- Frequent updates may happen with little warning.

Rippling is currently offering a one-month free subscription for TechRepublic readers only. Visit the link below to sign up.

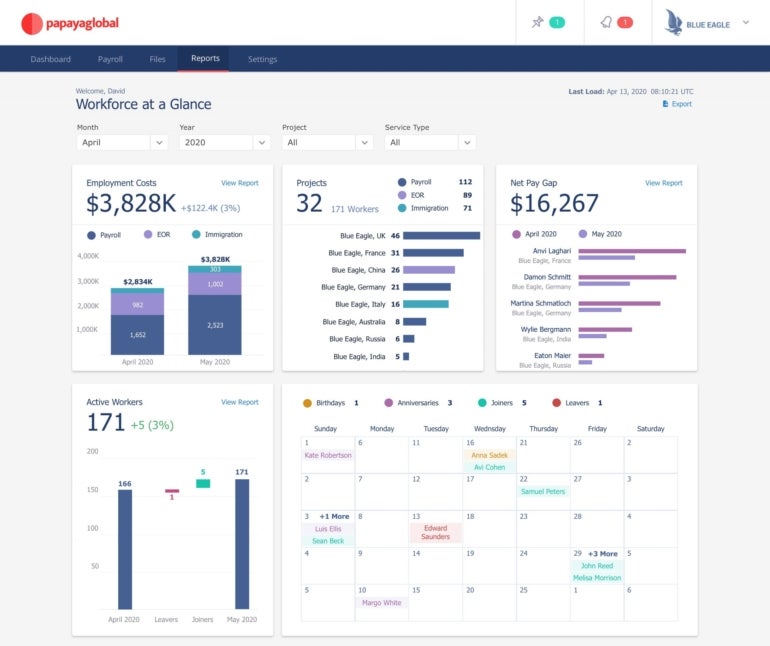

Papaya Global: Best for global payroll

Papaya Global is a leading global payroll and workforce management platform, providing businesses of all sizes with the tools and services they need to manage a global workforce. The platform offers a comprehensive suite of solutions, designed to help companies manage payroll, taxes, benefits, compliance and more in over 160 countries. (ADP Workforce Now has a strong international presence, but it’s available in slightly fewer countries than Papaya Global.)

With Papaya, businesses can accurately pay their employees, manage taxes and comply with local regulations, minimizing the burden of global payroll. Papaya Global’s services are designed to simplify the complexities of global payroll and HR operations, allowing companies to focus on their core business operations.

To learn more about Papaya’s plans and features, check out our Papaya Global review.

Papaya Global’s pricing

Papaya Global’s plans and prices vary depending on the customer’s specific needs. For the most part, the cost of the plans is based on the number of employees and services the customer requires. Papaya Global offers multiple plans for its services, including these:

- Full-Service Payroll: Starting at $12 per month per employee.

- Employer of Record: Starting at $650 per month per employee.

- Contractor Management: Starting at $2 per month per contractor.

Papaya Global’s key features

- HR and payroll features that cover onboarding, payroll, benefits, taxes, insurance and compliance.

- Catered solutions for 160+ countries.

- Automated payroll processing.

- Compliance with local labor laws.

- Secure storage.

Papaya Global pros

- Affordable payroll starting price.

- Streamlined payroll operations for multinational businesses.

- Straightforward cross-border and cross-currency payments.

- Payment tracking and progress monitoring features.

- Comprehensive international HR tasks, especially with automated global compliance features.

Papaya Global cons

- Newer mobile app with limited features.

- No self-guided setup option.

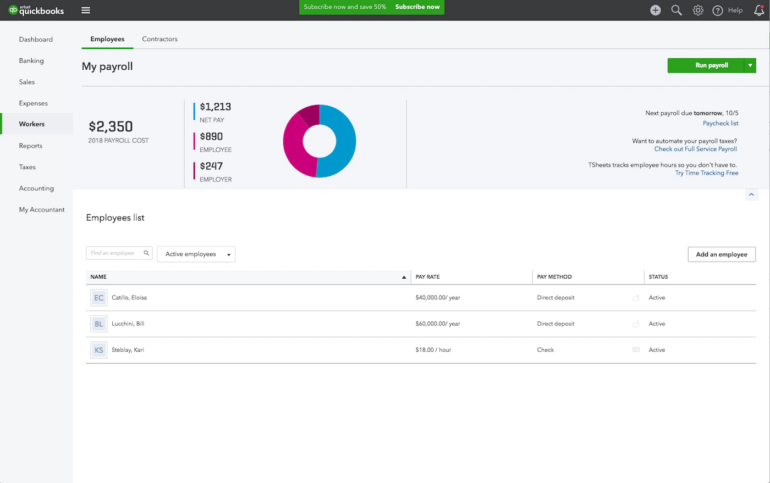

QuickBooks Payroll: Best for QuickBooks users

QuickBooks Online is one of the most popular accounting software solutions for small businesses. It is a comprehensive, cloud-based accounting option that offers features such as invoicing, payroll, accounts receivable, accounts payable and bank reconciliation. It also provides tools for tracking expenses, managing taxes and managing inventory.

QuickBooks Payroll is Intuit’s cloud-based payroll solution, and it syncs seamlessly with QuickBooks Online. (Although other payroll solutions, including ADP, sync with QuickBooks Online, QuickBooks Payroll doesn’t have any native integrations with accounting programs besides QuickBooks Online.) With QuickBooks Payroll, small and midsize businesses can find employee benefits, pay employees through same-day or next-day direct deposit, automatically file taxes and pay both employees and contractors with the same pay run.

To learn more about QuickBooks Payroll’s plans and features, check out our QuickBooks Payroll review.

QuickBooks Payroll’s pricing

Intuit QuickBooks Payroll has three main pricing plans:

- Core: $45 per month plus $6 per employee per month.

- Premium: $80 per month plus $8 per employee per month.

- Elite: $125 per month plus $10 per employee per month.

Additionally, QuickBooks Payroll offers a 50% discount on the base price for the first three months, but only if you opt out of the free trial.

QuickBooks Payroll’s key features

- Fast direct deposit.

- Employee health insurance options in all 50 states.

- Workers’ compensation insurance integration.

- Automatic full-service payroll processing in all 50 states.

- Well-reviewed self-service payroll app for employees.

QuickBooks Payroll pros

- Seamless integration with QuickBooks Online.

- User-friendly setup options.

- User-friendly interface with a low learning curve for current QuickBooks Online users.

- Health insurance and retirement plan benefits in every state.

QuickBooks Payroll cons

- Limited integration with third-party apps, including popular third-party accounting software.

- Free time tracking not included with cheapest plan.

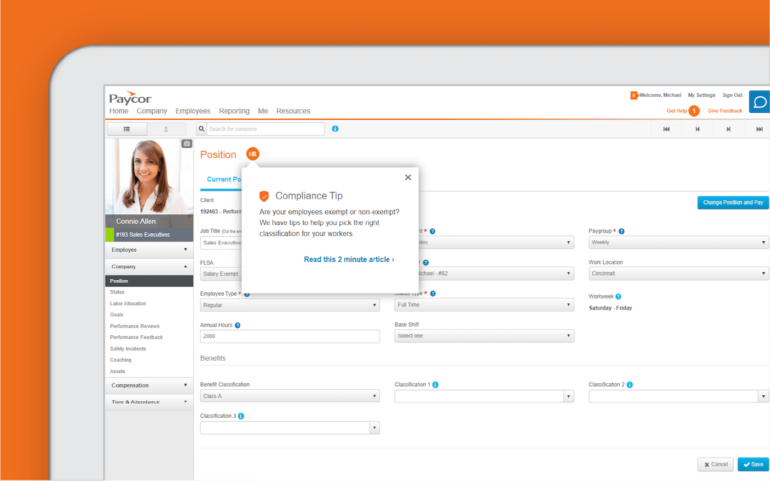

Paycor: Best custom configurations

Paycor is a leading provider of cloud-based software solutions that help businesses manage human capital. It offers a wide range of HR, payroll and talent management solutions to simplify and streamline how businesses manage their workforces.

Paycor’s solutions are tailored to meet the specific needs of each business. Like ADP, Paycor offers features that cater to small, midsize and large businesses, such as payroll processing, tax filing, employee onboarding, and time and attendance tracking. It also offers comprehensive reporting, analytics and a mobile app for employees and employers to access payroll and HR solutions easily.

To learn more about Paycor’s plans and pricing, check out our Paycor review.

Paycor’s pricing

Paycor doesn’t list pricing for any of its plans online. To get pricing information, you’ll have to first fill out a short questionnaire to get a custom quote or talk to Paycor’s sales team.

Paycor’s key features

- Customizable payroll, HR, time and attendance, recruiting and onboarding solutions.

- Web and mobile app accessibility.

- Employee self-service portal.

- Comprehensive reporting functions.

- 256-bit TLS 1.2 data encryption, MFA, IP filtering and other data security measures.

- Useful performance management tools, including tools for setting goals, tracking progress and rewarding performance.

- Thorough talent management features like recruitment, onboarding, compensation management and continuous talent development.

Paycor’s pros

- Useful insights via pulse surveys and sentiment analysis.

- Extremely comprehensive reporting, data and analytics features.

- Built-in learning management system.

- Industry-specific solutions.

Paycor’s cons

- No transparent online pricing.

- Potentially pricy plans.

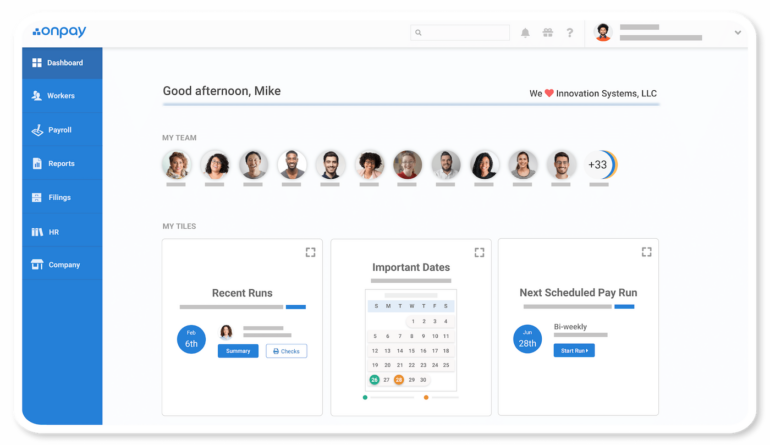

OnPay: Most user-friendly ADP alternative

OnPay’s cloud-based HR and payroll service helps small and mid-sized businesses manage payroll and benefits. OnPay provides tools for setting up payroll, tracking time and running reports. It also allows businesses to pay employees by adding funds directly to workers’ pay cards, direct deposit or paper check.

As an extremely user-friendly platform, OnPay is an ideal alternative to ADP for businesses looking to simplify complicated payroll processes. The platform can be integrated with other accounting and HR software. OnPay offers comprehensive services such as tax filing, employee onboarding and employee benefits. The platform also has a wide range of features geared toward helping businesses manage their payroll and benefits, such as custom rules and reporting, payroll tax compliance and onboarding tools.

To learn more about OnPay’s plans and pricing, check out our OnPay review.

OnPay’s pricing

OnPay offers one plan only with a flat fee of $40 per month plus $6 per employee per month. The fee includes all of OnPay’s tools, including payroll processing, direct deposit and tax filing.

OnPay’s key features

- Automated recurring payroll.

- Tax filing for federal, state and local taxes.

- Employee onboarding forms, self-service and direct deposit setup.

- Reports and analytics metrics.

- Optional employee benefits in all 50 states.

OnPay’s pros

- No additional fee for services that cost extra with most payroll software systems, including multi-state tax filing and wage garnishment.

- Free data migration and setup.

- User-friendly payroll solution appeals to first-time employers, including one-employee businesses.

OnPay’s cons

- Limited scalability.

- No built-in time and attendance tracking (third-party integrations only).

Paychex: Most HR features

Like ADP, Paychex offers a variety of payroll and HR products that small, midsize and large businesses can choose from as they grow. In particular, Paychex Flex is a close competitor to RUN Powered by ADP. Both are in-house software solutions for mid-tier businesses, offer a solid mixture of payroll and HR features, and include more than one plan option for scalability. Both Paychex Flex and ADP RUN include optional employee benefit add-ons in all 50 states, including retirement plans and health insurance.

Businesses can also choose Paychex’s PEO plan, Paychex PEO, for a fully outsourced HR and payroll system.

Paychex Flex has a lower starting price than most ADP plans. However, it either charges an extra fee for services that competitors like OnPay include for free or restricts services to the highest-tier plan.

To learn more about Paychex’s plans and pricing, check out our Paychex Flex review.

Paychex’s pricing

While Paychex Flex has three comprehensive payroll and HR solutions, it only lists pricing for its cheapest plan online:

- Paychex Flex Essentials: $39 + $5/payee (monthly).

- Paychex Flex Select: Custom pricing only.

- Paychex Flex Pro: Custom pricing only.

Paychex’s key features

- Automated full-service payroll.

- Extensive HR library with hundreds of templates and how-to guides.

- Self-service employee app.

- Optional PEO plan.

- Top-notch employee benefit options.

Paychex pros

- Hundreds of integrations.

- International payroll through Paychex’s third-party partner.

- More extensive HR library than most payroll software companies.

Paychex cons

- Additional fees for essential services, such as general ledger interfacing.

- Pricy plans with add-on fees may be beyond the reach of small and some midsize businesses.

Is ADP worth it?

ADP is worth it for businesses looking for a comprehensive suite of payroll, HR and benefits solutions. Along with its comprehensive features and general user-friendliness, ADP’s most unique selling point is likely its wide product range, which ensure ADP can cater to businesses of all shapes and sizes and in any imaginable industry:

- Roll by ADP caters almost exclusively to microbusinesses that want to run payroll as quickly as possible with minimal fuss.

- RUN Powered by ADP is a more full-bodied solution that includes HR features and multiple plans for growing small and midsize businesses.

- ADP Workforce Now makes HCM-level tools available to midsize businesses that want an all-in-one payroll, HR, benefits and general workforce management system.

- ADP TotalSource is an outsourced professional employer organization (PEO) solution for small businesses.

Few other organizations — with some notable exceptions, especially Rippling — can offer such a wide range of products that companies can easily toggle between as they grow.

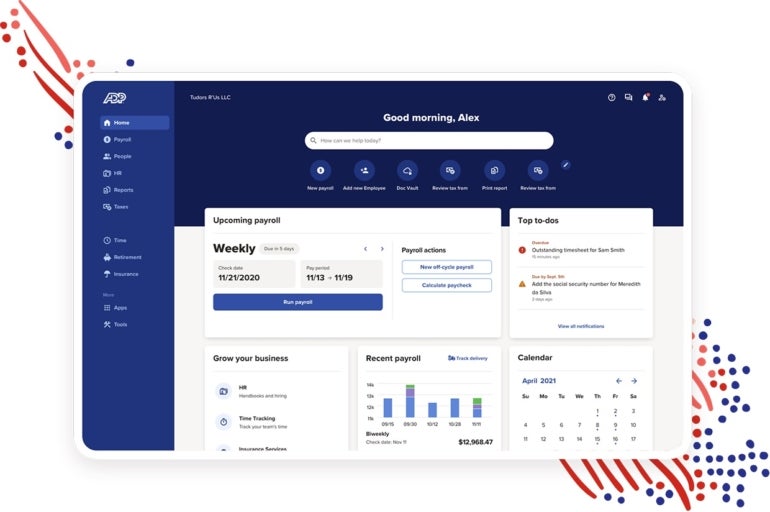

Image: ADPSince ADP offers such a diverse range of tools, it’s especially ideal for growing businesses that don’t want to change payroll providers while expanding from a startup with just a few employees to a multinational enterprise with workers all over the globe.

ADP’s platform is also incredibly user-friendly. No matter which of ADP’s many plans you choose from, you and your employees can pivot quickly to take advantage of ADP’s complete suite of powerful payroll and HR tools.

ADP pros and cons

ADP’s features, flexibility and scalability make it an attractive choice for many organizations. However, ADP has some pros and cons that you should consider before making a decision.

ADP pros

- Streamlines payroll processes, making paying employees quickly and accurately easier.

- Automates time and attendance tracking, allowing managers to monitor employee hours worked.

- Provides employee self-service options, enabling employees to access their own payroll and benefits information.

- Offers various payroll and HR services, including the ability to file taxes and manage employee benefits.

- Offers employer-specific payroll and HR services, such as employee onboarding.

- Integrates with other software such as accounting and HR systems for easier data sharing.

- Keeps businesses compliant with various federal and state laws, such as those related to payroll taxes and employee benefits.

- Provides true 24/7 customer support so businesses can get help when they need it.

ADP cons

- The system can be expensive, depending on what features and services are purchased, especially for smaller businesses.

- No transparent pricing.

- The system can be difficult to learn and requires specialized knowledge to get the most out of it.

- Some users have reported difficulties in navigating the user interface.

Do you need an alternative to ADP?

ADP is easily one of the best payroll providers in the software industry. It offers robust and comprehensive solutions for businesses of all sizes. At the same time, like any payroll solution, it definitely has potential drawbacks. For instance, some users may find that ADP’s user interface can be a bit cumbersome and difficult to learn. Additionally, some of ADP’s features come with a steep price tag, making it difficult for smaller businesses or startups to take advantage of them.

SEE: Payroll processing checklist (TechRepublic Premium)

Fortunately, there are several alternatives to ADP that offer similar features but with more user-friendly interfaces and better pricing structures. While you choose the best payroll processing software or service for your needs, be sure to consider your budget, your internal team’s skill sets, and any industry-specific compliance or security requirements that you need to abide by.

Read next: Top payroll processing services for small businesses (TechRepublic)

[ad_2]

Source link